Missing Trader VAT Fraud

Fraud is for telecommunication companies a wide problem. Several fraud scenarios are well know like IRSF, PBX hacking, Bypass, and could be managed using a Fraud Management System (FMS).

Nevertheless, there is a fraud mechanism that could severely affect the business of a company even if this company is using an FMS. This fraud mechanism is called Missing Trader VAT fraud and is a significant problem for both business and tax authorities.

This type of fraud becomes possible because of the way the VAT system works within the European Union. This article aims to describe the Missing Trader VAT fraud mechanism at least at the top level.

How it works?

As a first step, fraudsters create a company (telecom reseller in this case). As a second step, traffic is purchased and resold. Following the normal VAT mechanism, VAT is charged to and recovered from the end customer by the fraudster.

Up to this point, everything is ok. However the fraudster then disappears before having handed over the cash to the VAT authorities.

This in turn can cause a problem for the innocent party who has handed over the VAT to the crooks because the taxmen believe that they can recover it from said innocent party. This is a major risk for the business, especially as tax authorities can apply penalties.

They get you with the “should have known” clause. They repeated say that you must know your customer and your suppliers and you have to prove to them that you’re innocent – a reversal of natural justice.

It is important that you read the leaflet linked to below. If you do not take due care and HMRC can demonstrate that you knew or should have known that your trading was linked to fraudulent tax losses then you will lose your entitlement to claim the input tax linked to those transactions.

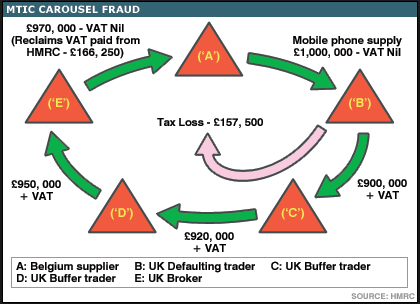

In reality of course, when a MTIC is established, it is made is a more complex way than the basic principle described above.

Indeed, the fraud can be perpetrated on genuine traffic, meaning that no alarm will be triggered by the FMS. Also, a “clean” supplier with which a customer has business relations since years can suddenly enter in this bad game

Last but not least, in many cases several companies involved in the supply chain are complicit (buffers). This help to hide the full picture if the fraud and enable carousel mechanism.

How to detect Missing Trader VAT Fraud?

We have seen that this fraud can occur on legitimate traffic which makes detection more complicated. For that reason, a number of different checks must be made on various aspects of the workings of a business: legal, financial, and traffic analysis.

This is especially although not uniquely for new interconnections. Existing interconnections also should also be regularly checked.

Market intelligence is also a great added-value in order to avoid to connecting with suspect companies or companies managed by people who have had issues with tax authorities in the past

Considering the nature of this fraud it is important to set up alert processes across your finance, legal and fraud management departments.

Sources:

MTIC (VAT fraud) in VoIP- B.U school of law/Boston University, School of law Working Paper No10_03. Richard T.Ainsworth

ETNO/ Missing Trader Fraud. Telecommunications Industry Standard Risk Management Process

HM Revenue & customs/ Missing Trader Intra Community (MTIC). VAT Fraud presentation. Joanne Cheetam MTIC National Co-Ordination Unit . 2012